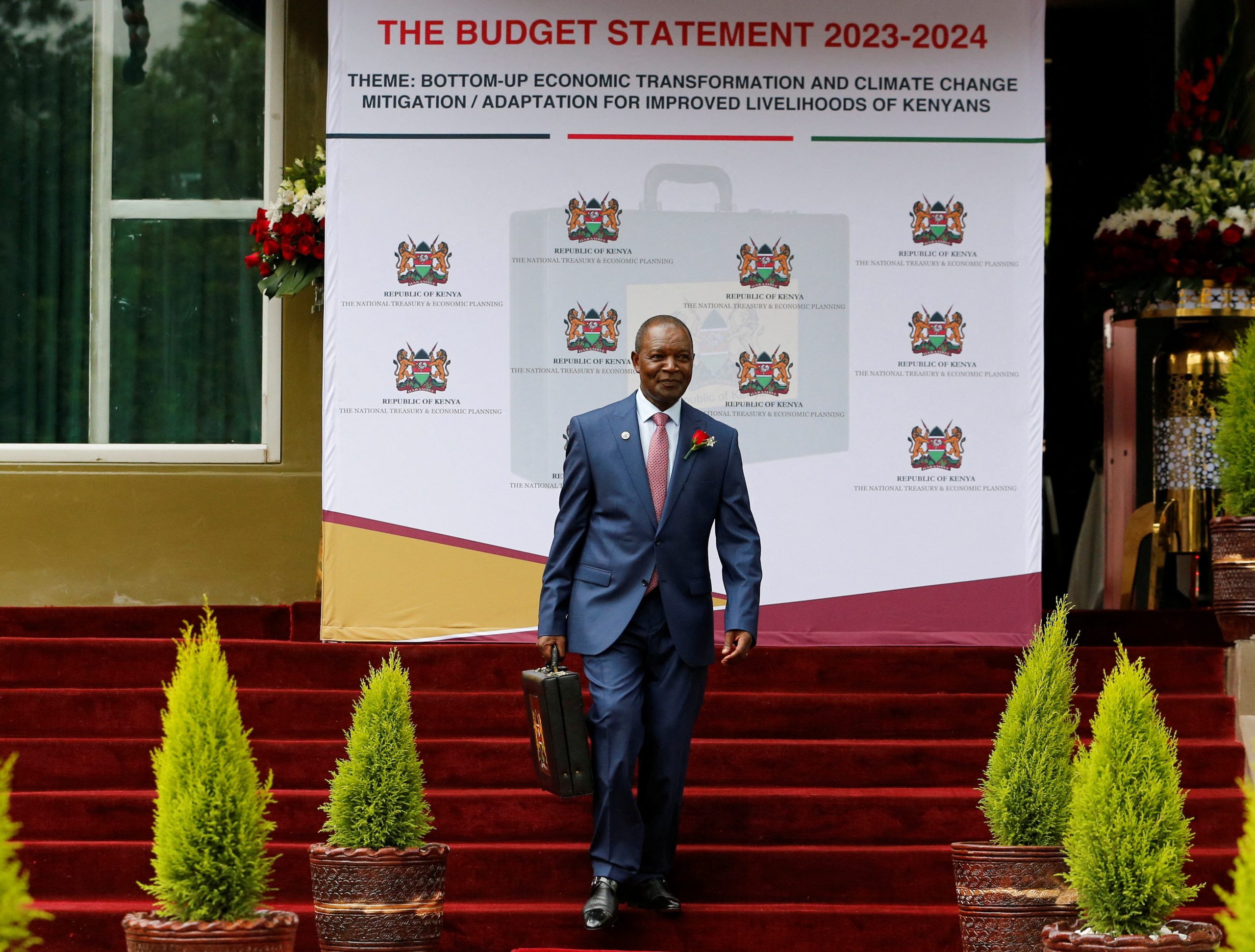

The Finance Budget or Financial budgeting is the process of planning expenses and revenues for a given period of time. On 15th June 2023, Treasury Cabinet Secretary Prof. Njuguna Ndung’u, a former Central Bank Governor, tabled Kenya Kwanza’s first Finance Budget in Parliament.

This was done to fulfil a tradition accustomed to East Africa Community member states. The EAC Treaty requires Finance Ministers of the party states to read their Finance Budget yearly.

The Finance Budget 2023/24 reading came a couple of hours after the proposed Finance Bill by President William Ruto was passed by Members of the National Assembly. The budget is set to take effect on July 1 to June 30 next year.

The Finance Budget is expected to establish President William Ruto’s bottom-up economic model, a notion he instilled to his supporters during campaign rallies towards the concluded general election.

He said that preparing the Sh3.6 trillion spending plan has been a delicate balancing act as the government seeks to unlock new revenue through the much-debated Finance Bill 2023.

“It’s the first Budget that I am going to present…It is also the first Budget under the Bottom Up Economic model. The premise of that is that we are coming from a very devastating kind of economic slowdown. We call it a perfect storm if you want to replicate what the Economic Advisory Team of the President has said.” Prof Ndung’u said in an interview on Wednesday.

However, the Budget presented to the Parliament by Prof. Njuguna Ndung’u received much criticisms as some members of the public showed a lack of faith in what the government drafted. This also saw opposition members of Parliament walk out of the House of National Assembly immediately after the Treasury CS took it to the stage.

“We’ve walked out because Azimio doesn’t believe in this budget. We don’t think this budget is made for the Kenyan people but for the Kenya Kwanza government. We will not participate.” Said Minority leader Junet Mohamed.

Government Budget Allocations.

Executive, which comprises ministries, departments and agencies (MDAs), will receive the bulk of the allocation at Sh2.16 trillion.

Parliament, which comprises National Assembly and Senate, will receive a total of Sh40.4 billion.

The judiciary has been allocated the least amount of money at Sh22.99 billion.

The 47 counties will receive Sh385.4 billion as part of the shareable revenue.

Other expenditure items will be what is known as the Consolidated Fund Services (CFS). CFS has been allocated a total of Sh1.836 trillion, taking the total spending in the financial year 2023/24 to Sh4.45 trillion.

The Finance Budget; Spending.

Housing and Land

“The cost of housing is a heavy burden to the majority of Kenyans and is the main factor driving the proliferation of slums in the country.”

The government plans to use housing as an economic opportunity through employment.

Allocations:

Sh35.2 billion to the housing programme

Sh7.3 billion Kenya urban programme

Sh5.5 billion Kenya Mortgage Refinance Company

Sh3.2 billion affordable housing units

Sh3.3 billion social housing units

Sh5.5 billion Kenyan informal settlement improvement project phase 2

Sh5.2 billion for construction of new markets

Sh932 million for maintenance of government pools

Sh1.2 billion for housing units for police and prisons

Sh637 millon for municipal programmes

Sh150 million footbridges

Sh300 million development of appropriate building technology

To ensure the legitimacy of land ownership: “I propose a budget allocation of Sh1.2 billion for the processing and registration of title deeds, Sh2.6 billion for settlement of the landless, Sh755 million towards digitisation of the land registry and Sh138.3 million for construction of land registries.”

Health

Treasury proposes to allocate Sh141.2 billion (3.8 per cent of the budget) to health sector.

Universal Health Coverage has been allocated Sh18.4 billion.

Kenya Covid-19 Emergency Response Project has received Sh3.7 billion.

Free maternity healthcare allocated 4.1 billion.

Managed Equipment Services has been allocated Sh5.9 billion

Medical cover for the elderly and severely disabled persons has received Sh1.7 billion.

To lower cases of Malaria and TB and HIV/AIDS in the economy, Sh24.8 billion has been proposed, under Global Fund in order to lower cases.

Sh4.6 billion has been proposed to enhance vaccines and immunisation programmes.

Health research and innovations allocated Sh4.9 billion.

Sh1.9 billion has been allocated for the construction of a cancer centre at Kisii Level 5 hospital

Sh500 million for strengthening cancer centre management at Kenyatta National Hospital.

Sh155 million for the establishment of regional cancer centres “in order to promote early diagnosis and management of cancer, and reduce the burden of treatment among Kenyans.”

“The government is committed to delivering universal health coverage to ensure every Kenyan attains dignified healthcare at a minimum cost.”

Security

Security is critical for creating a safe environment for investment and protection of the citizens.

Proposed the allocation of Sh338.2 billion to support operations of KDF, NPS, NIS and Kenya Prison Service.

Kenya Defence Forces – Sh144.9 billion

National Police Service – Sh98.6 billion

National Intelligence Service – Sh44.3 billion

Kenya Prisons Service – Sh31.3 billion

Technology

Treasury proposes to effect the budget allocation of Sh15.1bn to fund initiatives in the ICT sector.

Sh600 million for the government shared services to fast track the development of Konza technopolis city.

Sh4.8 billion for the horizontal infrastructure phase one

Sh1.2 billion for Konza data centre and smart city facilities

Sh475 million for construction of Konza complex phase one B

Sh5.7 billion for the Kenya Advanced Institute of Science and Technology at Konza

Sh1.3 billion for maintenance and rehabilitation of the national optic fibre backbone phase two expansion cable

Sh583 million for the maintenance and rehabilitation of the last mile county connectivity network.

“The digital superhighway will play a critical role in enabling govt to achieve the objectives of BETA (Bottom-Up Economic Transformation Agenda) as well as enhancing revenue collection through automation.”

Tourism, sports and culture and recreation

Treasury allocates Sh12.5 billion to tourism, sports, culture and recreation.

This includes an allocation of Sh6.4 billion under the sports, arts and social development fund.

Sh4.1 billion for the Tourism Fund

Sh2 billion Tourism Promotion Fund

Sh1.1 billion for human-wildlife conflict compensation

Sh800 million for wildlife insurance

Sh400 million for maintenance of access roads and airstrips in parks

Sh319 million for drilling of boreholes in protected areas for the provision of water for wildlife

Sh226 million for wildlife research facilities

“The government has prioritised expanding the space for creativity including freedom of expression and protection of intellectual property rights. We will also strengthen mainstreaming of arts and culture infrastructure and support cultural production and a creative economy. We are also cognizant of the brand value of Kenyans participating and excelling in the international sports arena as of ultimate importance to us.”

Read: Fuliza Ya Biashara; Safaricom Launches A New Product

Energy

Kenya Power, rural households and businesses and renewable energy win big in Sh62.3 billion allocation in the 2023/24 budget.

Sh33.8 billion allocated to the national grid system

Sh12.1 billion was set aside for the Rural Electrification Scheme (RES).

A further Sh11.4 billion will be used to tap and develop geothermal energy sources

Sh3.2 billion will go to supporting alternative energy technologies

Infrastructure

Infrastructure has been allocated Sh244.9 billion as one of the enablers of BETA.

Sh37.4 billion for the second phase of the standard gauge railway (SGR).

Sh579 million for rehabilitation of locomotives

Sh889 million for the development of Nairobi Railway City

Sh1.1 billion for Nairobi Bus Rapid Transit (BRT)

Sh300 million acquisition of ferries for Lake Victoria

Sh727 million for construction and expansion of airports and airstrips

Sh500 million smart driving licence

Sh2.6 billion infrastructure development for Dongo Kundu Special Economic Zone

Fight against corruption

Read: Kenya Budget 2022/2023 Full Speech, Highlights

Allocations:

Sh3.9 billion to Ethics and Anti-Corruption Commission

Sh3.6 billion for the Office of the Director of Public Prosecutions

Sh8 billion Directorate of Criminal Investigations

Sh8 billion for the Office of the Auditor General.

Education

The Treasury has allocated the Education sector Sh628.6 billion, translating to 17 per cent of the 2023/2024 budget.

Free primary education Sh12.5 billion

Free secondary education, including insurance under the National Health Insurance Fund Sh65.4 billion

Capitation for Junior Secondary Schools (JSS) Sh 25.5 billion

Teachers Service Commission (TSC) proposed allocation increased to Sh316.7 billion from Sh300.1 billion

Allocation to university education slashed from Sh108 billion to Sh97.5 billion

Helb allocation doubled to Sh30.3 billion from Sh15.8 billion

“The government will continue to address inequality in our education system in order to level the playing field for all children despite their background.”

Manufacturing

Sh26.9 billion budget for the development and promotion of industries through various ministries:

Sh4.7 billion for county-integrated agro-industrial parks

Sh3 billion for six Export processing zones

Sh3.1 billion to support access to finance and enterprise recovery project.

Sh500 million for Special Economic Zones Textile Park in Naivasha

Sh1.8 billion for the construction of an effluent treatment plant at Kenanie in Machakos

The revitalisation of cash crops for industries:

Sh120 million for cotton

Sh62 million for coconut

Sh35 million for cashew nuts

Sh150 million for pyrethrum

Sh100 million for modernisation of co-operative cotton ginneries

Sh134 million for national edible oil crop production project.

Sh270 million for sugar reforms support project

Sh1.5 billion for Kenya’s industry and entrepreneurship project to provide essential internship opportunities for the youth

Sh300 million for Kenya Youth Employment and opportunity project

Sh332 million for the construction of industrial research laboratories

Sh182.9 million for constituency industrial development centres

“In order to improve productivity in the manufacturing sector, the government will adopt a value chain-based approach through the Bottom-Up Economic development agenda. This will address bottlenecks that have impeded the growth of the manufacturing sector in order to create jobs and enhance the economy’s competitiveness.”

Taxation

Betting and alcohol adverts

Treasury proposes the introduction of a 15 per cent excise duty rate of excisable value of fees charged on advertisement by all televisions, print media, billboards, and radio stations in promotion of alcohol, gaming, lottery and price competition.

“Consumption of alcohol, betting, gaming, lottery and price competition are extremely addictive and result in harmful repercussions in the society, especially the youth.”

New tax bands

Only 26,676 employees, who constitute 0.8 per cent of total employed workers in the country, are affected by the newly introduced top tax bands of 32.5 per cent and 35 per cent targeting those earning above Sh500,000 per month.